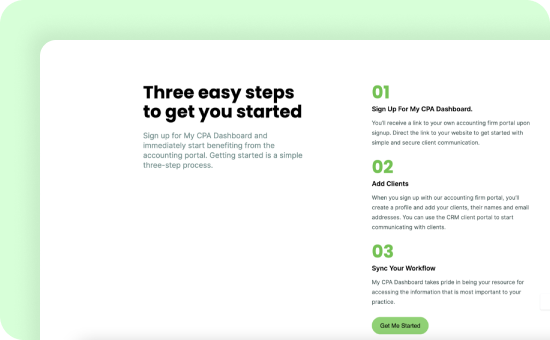

Esketchers developed AI-powered fintech solutions for the practice management of CPAs, bookkeepers, and tax professionals. The software features a secure client portal, cloud-based document storage, easy file sharing, payroll processing, compliance tools, and integrated e-signatures to streamline approvals and communication with clients.

AI-Powered Fintech Solution For CPA Practice Management

AI-Powered Fintech Solution For CPA Practice Management

Problem

The client approached us with challenges accounting professionals often face, like disorganized communication, document overload, getting bank statements from clients, book-keeping and time-consuming manual tasks.

Solution

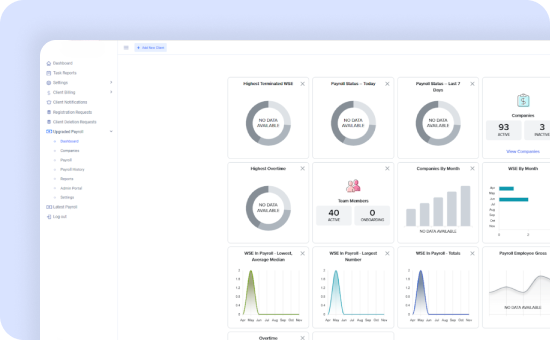

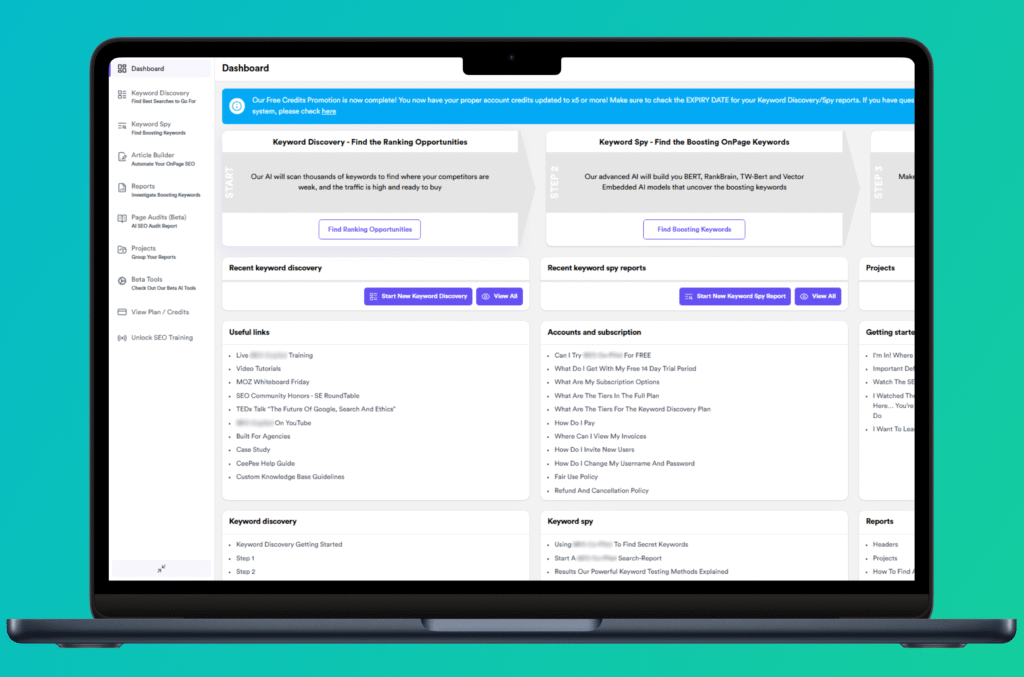

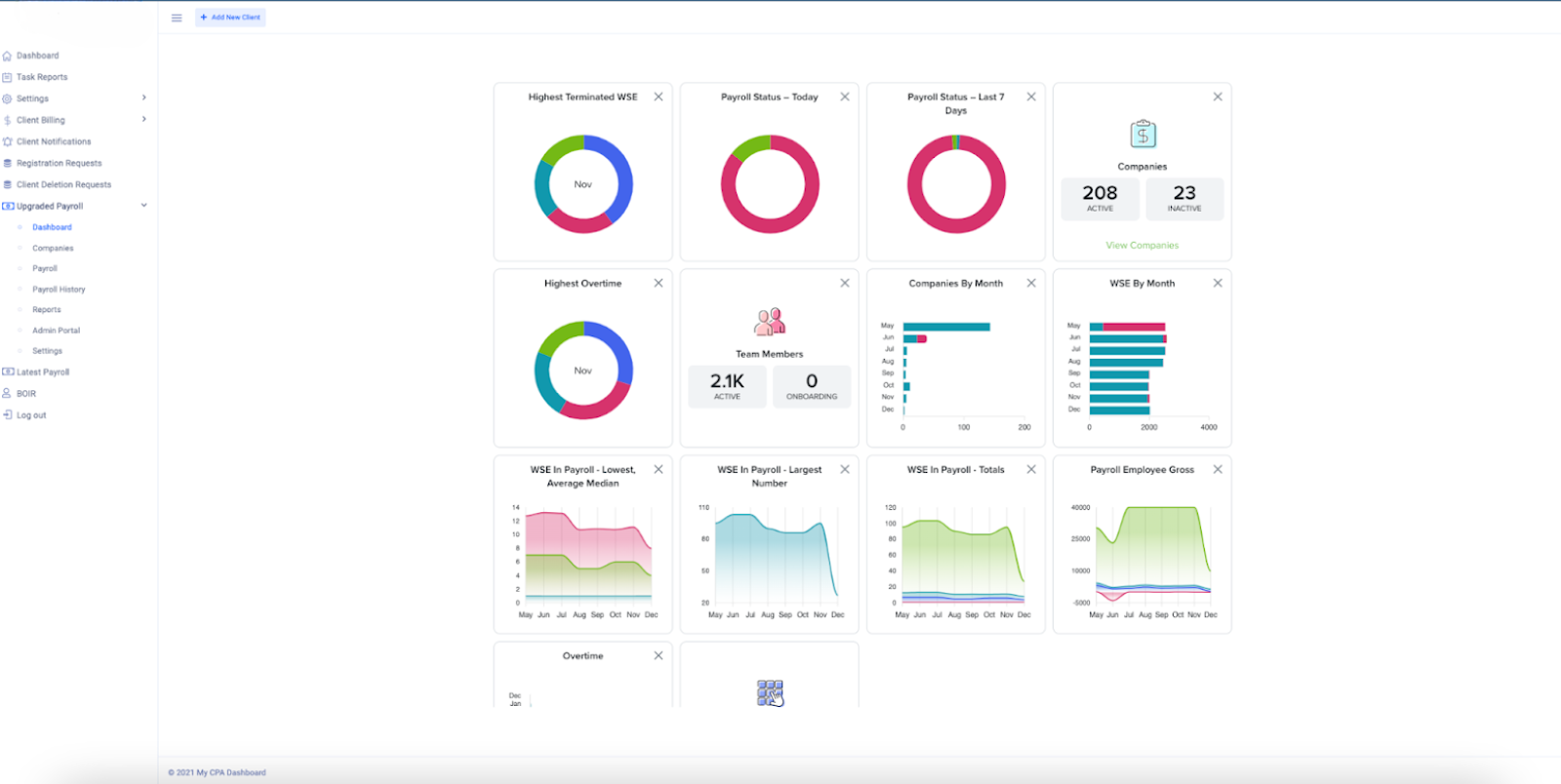

Designed a web and mobile app to streamline and simplify the management of financial data and day-to-day accounting tasks for CPAs (Certified Public Accountants). It provides an interactive dashboard that allows users to monitor and manage various aspects of their accounting and client data.

Use Cases

Team

Services we offered

Market Specifics

Deliverables

Client Goals

The client is a CPA himself and wanted to develop a comprehensive platform designed to help Certified Public Accountants (CPAs) efficiently manage client data and financial processes. The key objectives of the platform include:

Client Management

Offering a centralized space for CPAs to manage and track their clients’ financial information, ensuring that records are organized and easily accessible.

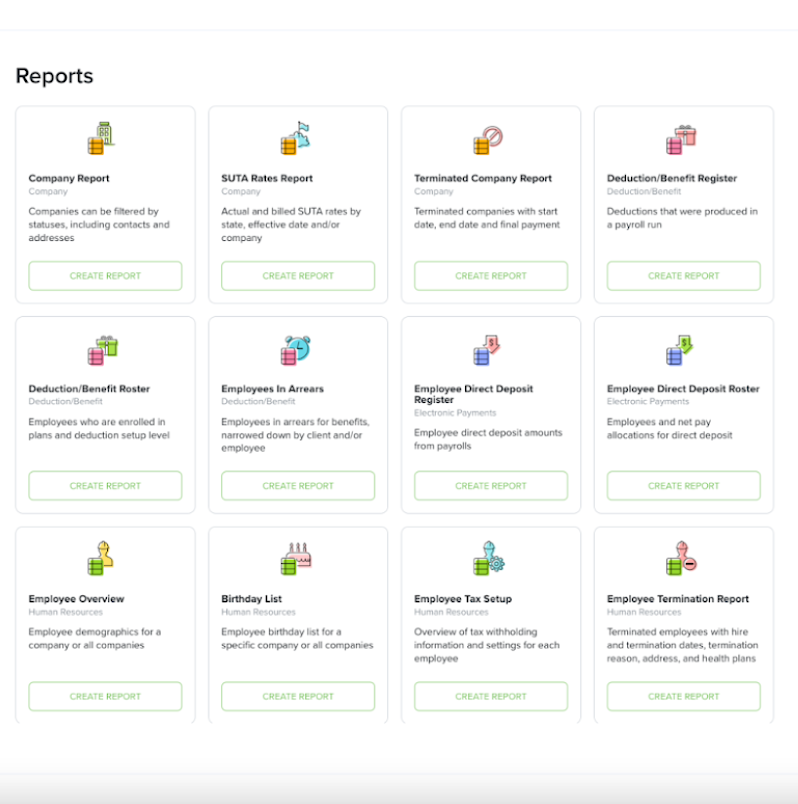

Customizable Financial Reporting

Enabling CPAs to generate detailed, tailored financial reports to assist with client tax filings, regulatory compliance, and financial analysis.

Payroll Management

A feature designed to automate salary calculations, tax deductions, and benefit distributions. It ensures compliance with legal standards and integrates with existing HR and accounting tools to streamline workforce financial processes.

Collaboration Tools

Integrating features that allow CPAs to communicate directly with clients, share documents securely, and streamline collaboration on financial matters. CPAs can manage their client payroll.

Workflow Automation

Automating time-consuming tasks such as bookkeeping, tax calculations, and data entry to improve efficiency and reduce the risk of errors.

Data Security and Compliance

Ensuring that the platform provides secure storage and access to sensitive financial data while adhering to industry standards and regulations.

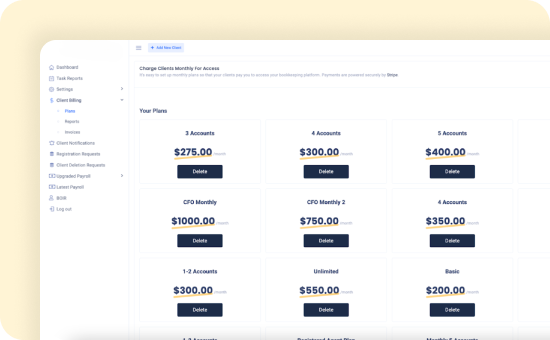

Keep track of client billings

Facilitating accurate tracking and management of client invoices, payments, and outstanding balances, with features for automated reminders and detailed billing reports to ensure timely collections and transparency.

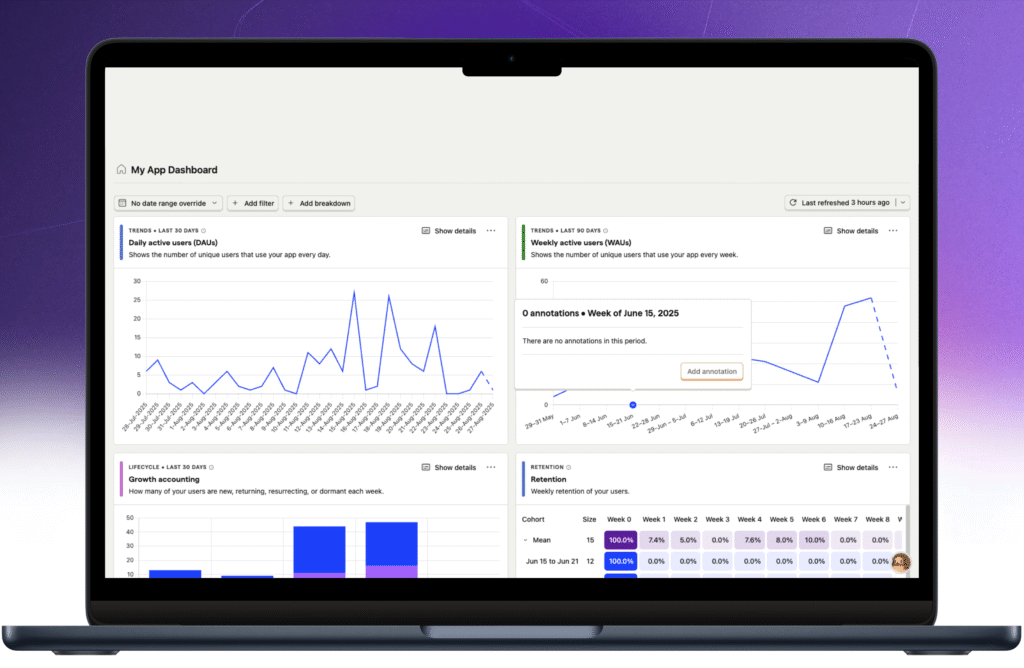

Analytics and Insights

Providing CPAs with real-time analytics to gain insights into their clients’ financial health, enabling more proactive and informed advisory services.

User-friendly Interface

Designing an intuitive and easy-to-navigate platform that simplifies complex accounting workflows, allowing CPAs to focus on delivering value to their clients.

Scalability and Flexibility

Building the platform to be scalable and flexible, enabling it to grow with the CPA’s practice and adapt to evolving business needs, ensuring long-term sustainability.

Finicity integration

Provide seamless access to financial data through the Finicity API. Automate financial reporting and credit verification processes.

Target audience

CPAs

Accountants

Bookkeepers

Tax professionals

Accounting Firms

Core Features

Stripe Integration

The platform seamlessly integrates Stripe with your CRM, enabling secure payments, automated invoicing, multi-currency transactions, and payment tracking. Accountants can also set up weekly/monthly subscription plans and manage invoices, bills, and receipts efficiently.

Online Document Storage

Users can upload, organize, and store important files securely, as well as share and request documents with automated reminders to ensure timely collaboration.

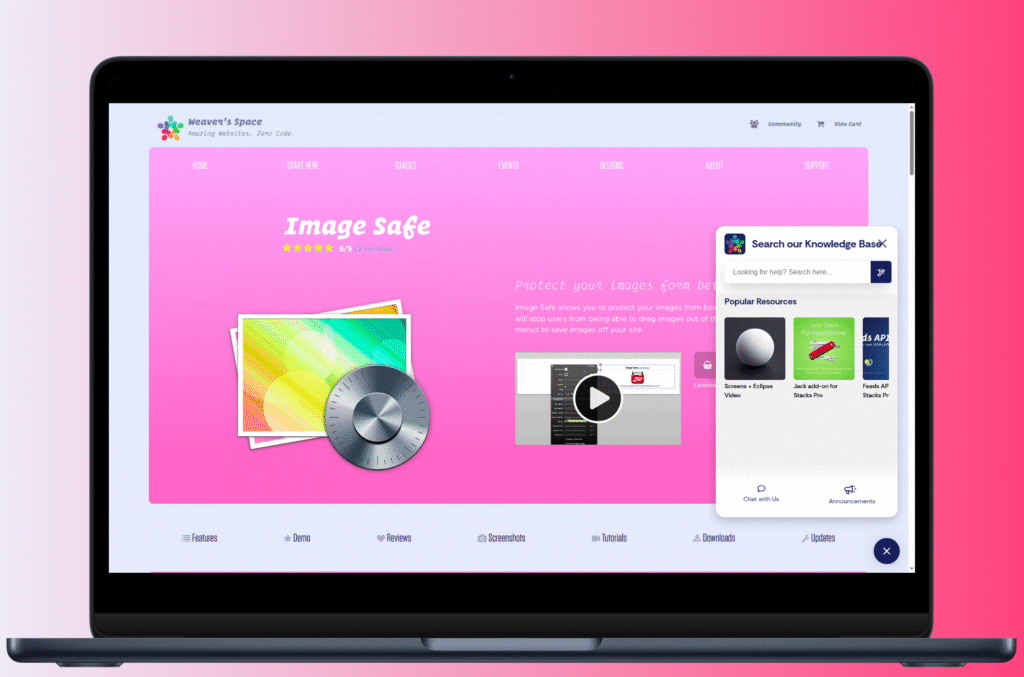

Client Portal

The client portal enables secure communication and document sharing between CPAs and clients, offering streamlined workflows for CPAs to efficiently manage client interactions.

Secure File Sharing

Manage file permissions with share/limit/revoke options, organize files in custom folders, and generate monthly progress reports for stakeholders. Automated email alerts support tasks and file sharing, while built-in invoicing helps prepare and manage bills and receipts.

e-Signature

Simplify document signing with status tracking, reminders, and separation of signed/unsigned files. Supports API integrations for document management and ensures full legal compliance with audit-ready authenticity.

Easily Assign Tasks

This feature enables the tracking of assignments and project progress, while also allowing the assignment of tasks and setting deadlines for both team members and clients.

Finicity API Integration

The integration pulls real-time financial data to generate instant, accurate reports and insights.

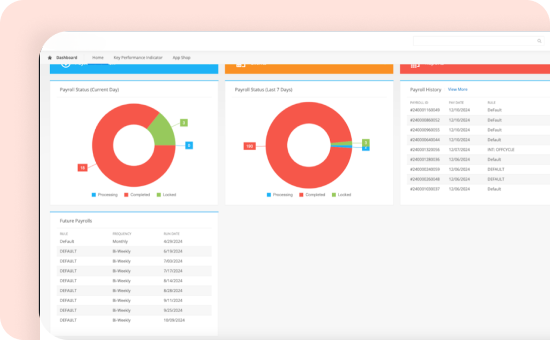

Payroll

Payroll management feature to automate salary calculations, tax deductions, and benefit distributions. It ensures compliance with legal standards and integrates with existing HR and accounting tools to streamline workforce financial processes.

Additional features

Client Activity Tracking

Provides insights into client actions, such as document uploads or task completions.

Automated Workflow Templates

Pre-designed templates for common accounting workflows, such as tax filings and financial audits.

Custom Reports

Generate detailed, client-specific reports that provide financial insights or project summaries.

Audit Trail

Track every action taken in the platform to maintain transparency and compliance.

Calendar Integration

Sync deadlines, appointments, and events with third-party calendars like Google Calendar and Outlook.

Multi-User Support

Enables firm-wide collaboration with role-based access to maintain data integrity and confidentiality.

Data Backup and Recovery

Automated backups and recovery options ensure no data is lost due to unforeseen issues.

Achievements

Industry Adoption

Widely adopted by CPAs and accounting firms across the U.S., the platform enhances client management, simplifies workflows, and improves communication between accountants and clients, earning consistent positive feedback.

Efficiency Gains

By streamlining client, task, and document management, the platform boosts productivity, saves time and resources, and reduces errors with automated reminders and task tracking.

Enhanced Security

Built with trusted, compliant data protection for sensitive financial information, the platform also integrates e-signatures to securely handle legal and official processes.

Brand Customization Success

White-labeling options let firms tailor the platform to their brand identity, strengthening professionalism and client trust.

Technological Innovation

With features like task automation, client activity tracking, and calendar integration, the platform delivers a feature-rich ecosystem that scales effectively for firms of all sizes.

Financial Impact

By consolidating essential functions, firms save costs, increase client retention, and achieve stronger revenue growth.

Tech Stack

Front-End

Back-End

Integrations

Quality Assurance Strategies

To guarantee a high-quality platform, we adopted a comprehensive Quality Assurance (QA) framework throughout the development cycle. These strategies were instrumental in optimizing performance, fortifying security, and enhancing usability.

Early Involvement in Development (Shift Left Testing)

QA processes began in the earliest development stages, with QA specialists collaborating with developers and product managers from the planning phase. This early involvement helped uncover potential issues and solidify requirements, reducing defects before they could occur.

User Acceptance Testing (UAT)

Before the platform’s release, we conducted extensive User Acceptance Testing (UAT) with end-users to confirm it aligned with their expectations and operational requirements.

Cross-Platform and Cross-Browser Testing

Delivering a consistent user experience across devices and browsers was a priority. We utilized advanced tools to verify seamless functionality on multiple platforms (mobile, tablet, desktop) and browsers such as Chrome, Firefox, and Safari.

Continuous Integration and Continuous Testing

Continuous Integration and Continuous Deployment (CI/CD) pipelines were established to automate testing with every code update. This approach ensured all changes were rigorously validated before going live.

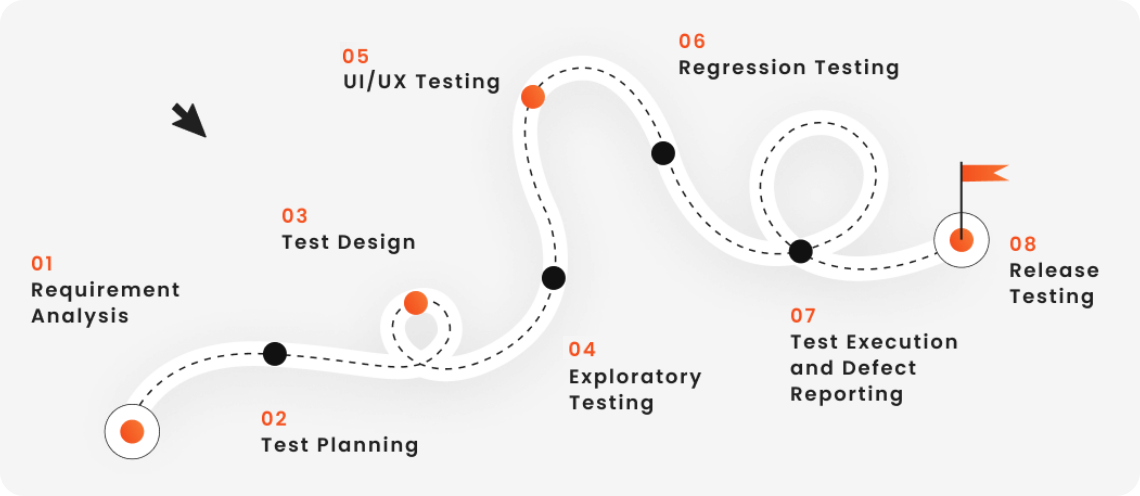

Testing Methodology

To ensure the platform’s quality and reliability, we employed a structured and iterative testing methodology. This approach covered all critical aspects of functionality, performance, and usability, ensuring the platform met user expectations and business goals.

Requirements Analysis and Test Planning

- Collaborated with stakeholders to understand and document detailed functional and non-functional requirements.

- Developed a comprehensive test plan outlining scope, objectives, testing types, tools, and timelines.

Test Case Development

- Designed detailed test cases and scripts based on requirements and user stories.

- Ensured test cases addressed all possible scenarios, including edge cases, to validate the platform’s robustness.

Unit Testing

- Conducted by developers to validate individual components or modules.

- Ensured each module functioned correctly in isolation before integration.

Integration Testing

- Verified interactions between integrated components.

- Ensured smooth data flow and functionality across modules.

System Testing

- Conducted end-to-end testing of the entire platform to validate compliance with requirements.

- Focused on functional, security, and performance testing to ensure a high-quality user experience.

Cross-platform and Cross-Browser Testing

- Tested the platform on various devices (mobile, tablet, desktop) and browsers (Chrome, Safari, Firefox) using automated and manual testing tools.

- Ensured consistent behavior and performance across environments.

User Acceptance Testing (UAT)

- Conducted with a group of real users to validate that the platform met their needs and expectations.

- Incorporated feedback to refine and enhance the platform before launch.

Bug Tracking and Resolution

- Used robust issue-tracking tools to log, prioritize, and resolve defects.

- Collaborated closely with development teams for quick resolution and re-testing.

Why we used this particular methodology?

This methodology was selected to ensure a high-quality, reliable, and user-focused platform. Here’s why:

Comprehensive Coverage

It addressed every stage of development, from unit tests to performance validation, ensuring robust quality assurance.

Early Issue Detection

Shift Left Testing allowed us to identify and fix defects early, reducing costs and complexity.

User-Centric Approach

User Acceptance Testing ensured the platform met real-world needs, enhancing user satisfaction.

Cross-Platform Consistency

We validated functionality across devices and browsers for a seamless experience.

Performance Assurance

Load and stress testing confirmed scalability and reliability under varying conditions.

Project Management

Agile Methodology

Used Agile methodology to allow flexible planning and adapt to changes quickly.

User Feedback

Collected user input regularly and made improvements based on it.

Team Collaboration

Developers, designers, and testers worked together closely.

Tools Used

Figma, managed tasks with Asana communicated through Skype.

Scrum Process

Held daily check-ins, planned sprints, and reviewed progress regularly.

Planning

Carefully schedule tasks, assign resources, and set clear milestones to meet deadlines.